Confused about recent discussions on changes to the Unit Titles Act 2010? We’re here to help. Here’s a concise breakdown of the Unit Titles (Strengthening Body Corporate Governance and Other Matters) Amendment Act 2022 and how it updates the original Unit Titles Act 2010.

The Unit Titles Act 2010 governs the ownership and management of multi-unit properties in New Zealand, such as apartments and townhouses. It provides a framework for creating, managing, and governing unit title developments, ensuring fair and efficient management while protecting stakeholders’ rights and responsibilities.

As of 9th May 2022, the Unit Titles (Strengthening Body Corporate Governance and Other Matters) Amendment Act 2022 has been in effect.

Why the change?

The amendment aims to enhance safeguards for unit title property owners and buyers. Most changes took effect in May 2022, with provisions for remote meeting attendance starting on 9th December 2022. Additional revisions were enacted on 9th May 2024.

Key Updates to the Unit Titles Act

- Wider Range of Information for Prospective Buyers: Ensuring buyers have comprehensive property and body corporate details.

- Strengthened Governance of a Body Corporate: Enhancing rules and structures for body corporate operations.

- Ensuring Adequate Planning for Maintenance: Requiring thorough and proactive long term maintenance plans.

- New Dispute Rules and Fees: Introducing updated rules and fees to better handle disputes.

- New Regulatory Powers to Improve Compliance: Enhancing authorities’ powers to enforce compliance and proper management.

- Raised Standards for Body Corporate Managers: Implementing higher standards for body corporate managers.

Want to jump to a section? Click on the links below:

Prospective Buyers & Sellers

A wider range of information needs to be provided to prospective buyers, granting additional rights to buyers if these requirements are not met. This includes:

Pre-contract disclosure statement information

Before entering into a sales and purchase agreement, sellers must provide a wider range of information in the pre-contract disclosure statement. This includes:

-

- *Financial Statements: Detailed financial information about the property.

- *Long-Term Maintenance Plan (LTMP):

- Information regarding past and ongoing maintenance.

- The body corporate must provide the LTMP and next review date, any maintenance works to be carried out in the next three years must be identified and how upcoming works are to be funded must be disclosed.

- *Any Earthquake-prone issues

- Weather-tightness: Any weather-tightness issues (ongoing or previous remedies) must be disclosed.

- Previously, vendors had to disclose whether the unit or common property had been the subject of a claim under the Weathertight Homes Resolution Services Act 2006. Many buildings with weather-tightness issues were not subject to such claims, leading to potentially misleading or insufficient information for purchasers.

- Body Corporate Meeting Notices and Minutes: Notice (also known as Agenda) and Minutes from general meetings for the previous 3 years.

- Significant defects: It is compulsory to disclose if the property has any significant defects.

- *Body Corporate Manager: Name and details.

- *Remediation Reports: Any remediation reports received by the Body Corporate in the preceding three years.

- Insurance: Details of insurance including the insurer’s name and contact details, type and amount of cover, annual insurance premium, the excess payable for any claim, specific exclusions from cover and information on where and how to view the insurance policy. This would previously have been given to a purchaser at the Pre-Settlement Disclosure stage.

- Court or Tribunal Proceedings: Disclosure of any proceedings the body corporate is involved in, including details of the proceedings.

- Previously, some of this information was required in the Pre-Settlement Disclosure Statement. Which did not help purchasers to make an informed decision to purchase, as a contract to purchase had already been entered into.

- *Off-the-plan units: A summary of the draft financial budget and estimated ownership interests (based on sale value and proposed utility interest) must be provided.

*This is a new requirement.

Pre-settlement disclosure statement

Once the sale and purchase agreement are in place, sellers must provide a pre-settlement disclosure statement at least 5 working days before settlement, including crucial details to ensure transparency and informed decision-making.

Ability to Cancel an Agreement or Delay Settlement

Previously, purchasers could only cancel the agreement if the Disclosure Statement was not provided within the required timeframe. Now buyers can delay settlement or cancel the sale and purchase agreement under specific conditions related to the pre-contract and pre-settlement disclosure statements:

- Late, Incomplete, or Inaccurate Disclosure: If the disclosure is late, not provided, incomplete, or inaccurate, the buyer may take action.

- Statutory Consequences: There are now statutory consequences for failing to provide a complete and accurate disclosure statement.

- Notice to Delay Settlement: If the seller fails to provide a complete and accurate pre-settlement disclosure statement at least 5 working days before settlement, the buyer can delay settlement until 5 working days after receiving the corrected statement.

- Notice Requirement for Cancellation: To cancel the sale, the buyer must notify the seller of their intent, allowing the seller to rectify any issues. If the seller promptly provides an amended and accurate statement, the buyer cannot cancel the agreement under this provision.

These provisions ensure buyers are adequately informed and protected, promoting transparency and fair dealings.

Body Corporate Owners

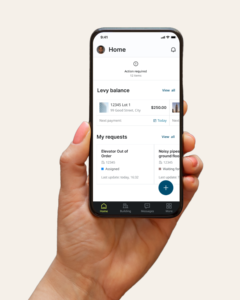

- Remote Attendance and Electronic Voting: Owners and committee members can attend meetings in person or remotely and vote electronically.

- Information Responsibilities: Committees must have meeting agendas, maintain records, and distribute minutes within one month.

- Code of Conduct: Members must act honestly, fairly, and comply with relevant laws.

- Conflicts of Interest: Members must disclose personal interests, and conflicts must be managed transparently.

- Service Contracts and Signage Agreements: Contracts signed by the developer of a body corporate at the completion of the development are limited to 24 months post-control period unless specific protections are included.

Remote Attendance at meetings and electronic voting

Remote Attendance at meetings and electronic voting

Unit owners and committee members can now attend meetings in person or remotely via audio or video link. Electronic voting options are available:

- Electronic Voting: Owners can vote electronically before a meeting via online forms or by emailing postal voting forms.

- Proxy/Remote Attendance: Owners can appoint a proxy to attend remotely and vote on their behalf, enhancing participation in governance.

Information responsibilities of body corporate committees

- Meeting Agenda and Records: Committees must create agendas, maintain written records, record decisions, and report back to the body corporate. Decisions are made by a voting majority.

- Meeting Minutes Distribution: Committees must make meeting minutes available to all unit owners within one month, either electronically or as a physical copy upon request, ensuring transparency and accountability.

Code of Conduct for Body Corporate Committee members

Committee members must adhere to a code of conduct, requiring them to:

- Act honestly and fairly in all dealings.

- Comply with the Unit Titles Act, Regulations, and other relevant legislation.

Conflicts of interest

Committee members must disclose any personal interests in matters before the committee, such as receiving any financial benefit from a decision made by the committee.

- Register of Interests: The committee must maintain a register of these interests, accessible to committee members and unit owners, ensuring transparency.

- Handling Conflicts of Interest: Members with conflicts cannot vote or participate in related decisions but count towards the meeting’s quorum. Failure to disclose an interest requires committee notification but does not invalidate decisions.

Ensuring adequate planning for maintenance

Previous Requirements:

- A body corporate needed a LTMP covering at least 10 years, with a review every 3 years.

New Requirements for Large Developments:

- Large unit title developments (10 or more principal units) must now establish a LTMP covering 30 years from the plan’s commencement or last review.

- A large unit title development’s long-term maintenance plan must provide a high-level indication of the expected cost of maintenance and replacement of the items covered by the plan in respect of years 11 to 30.

- Reviews must occur every 3 years and promptly upon awareness of any significant impact on the plan.

Purpose of the LTMP:

- Summarises the condition of common property.

- Identifies future maintenance needs and estimates associated costs.

- Supports the creation and management of long-term maintenance funds.

- Guides unit owners in levying for maintenance costs.

- Provide ongoing guidance to the body corporate to assist the body corporate in making annual maintenance decisions.

These requirements ensure proactive maintenance planning and financial management for the upkeep of unit title developments.

Resolving disputes

Tenancy Tribunal for Unit Title Disputes

Dispute Threshold and Application Costs:

- Increased Threshold: Disputes relating to unit title properties involving amounts less than $100,000 can now be mediated or adjudicated at the Tenancy Tribunal. Up from $50,000 previously.

- Application Fees: Costs for applying to the Tenancy Tribunal have been reduced:

- $250 for mediation.

- $500 total for disputes requiring adjudication (a hearing). If initially paid $250 for mediation, an additional $250 is required if the dispute proceeds to adjudication.

- Maximum Fee: The maximum total fee payable for any dispute is $500.

Who Can Apply to the Tribunal

Who Can Apply to the Tribunal

Applications can be made by or against:

- Unit owners

- Unit occupiers (tenants)

- Body corporates

- Body corporate managers

- Parties to signage agreements

Court Jurisdiction for Unit Title Disputes

- District Court Jurisdiction:

- Handles disputes related to the application of insurance monies up to $50,000.

- Handles other disputes ranging between $100,000 and $350,000.

- Does not handle disputes about land title.

- High Court Jurisdiction:

- Handles disputes related to land title.

- Handles disputes related to the application of insurance monies over $50,000.

- Handles any other disputes exceeding $350,000 in value.

These jurisdictions ensure that unit title disputes are heard at the appropriate level of court based on the nature and financial scope of the dispute involved.

Utility interest and charges to unit owners

Utility Interests in Unit Title Developments

Developers assign utility interests to each principal and accessory unit in unit title developments, determining each unit’s share of body corporate levies.

- Nature of Utility Interests: These can be aligned with ownership interests or calculated separately.

- Single or Multiple Utility Interests: Developers can assign a single utility interest or multiple interests specific to certain services or amenities. For example, amenities like lifts may have utility interests assigned only to benefiting units.

- Reassessment by Body Corporate: Through a special resolution, the body corporate can reassess utility interests, potentially assigning new single or multiple utility interests based on evolving needs or usage patterns.

These provisions ensure flexibility in managing and allocating utility costs among unit owners, reflecting the diverse needs and amenities within the development, to improve compliance.

Charging for Metered Services in Unit Title Developments

A body corporate can install meters and levy charges on unit owners for amenities or services provided to both principal and accessory units within the development.

- Types of Units Covered:

- Principal Units: Includes apartments, townhouses, units, shops, commercial and industrial units.

- Accessory Units: Includes carparks, garages, or storage spaces.

- Example Application:

- The body corporate can install meters on accessory units to charge unit owners for supplying electricity, such as for charging electric vehicles.

This provision ensures fair and transparent billing for specific services or amenities used by individual units, accommodating evolving needs and technological advancements in unit title management.

New regulatory powers

New Monitoring Function and Enforcement Measures

The Ministry of Business, Innovation and Employment (MBIE) has been empowered with six new enforcement measures under the Unit Titles Act:

- Proactive Compliance Monitoring: MBIE can now monitor and assess compliance by bodies corporate and body corporate managers proactively, rather than solely reacting to complaints.

- Enforcement Actions: If a body corporate or unit owner breaches their obligations, the affected party may initiate action through the Tenancy Tribunal or courts.

- Document Requests: MBIE can request documents necessary to fulfil its functions under the Act. These documents must be provided within 10 working days of the request. MBIE may inspect, record, or make copies of these documents as needed.

These measures enhance regulatory oversight and ensure compliance to safeguard unit owners’ interests and promote effective management of unit title developments.

Power of entry

Power of entry

MBIE can enter and inspect a unit title development:

- With the consent of the body corporate or unit occupant (for the principal or accessory unit) to investigate whether a breach has occurred.

- When authorised by an order of the Tenancy Tribunal and with written notice given. If MBIE has reasonable grounds to believe there has been a breach, and the inspection is reasonably necessary, MBIE must provide 24 hours’ written notice.

The power of inspection includes the ability to take photographs, video recordings, or samples to test. The body corporate must give MBIE reasonable assistance to enable access and allow them to carry out the inspection, with an authorised person from the body corporate present.

Improvement Notices under the Unit Titles Act

MBIE can issue an ‘improvement notice’ for breaches or anticipated breaches of the Act or its regulations:

- Issuance: MBIE may issue an improvement notice if it identifies a breach or likely breach of the Unit Titles Act or regulations.

- Challenging the Notice: The recipient has the right to challenge it in the Tribunal within 28 days of issuance.

- Withdrawal: MBIE can withdraw an improvement notice if circumstances warrant it.

- Penalties for Non-Compliance: Failure to comply with an improvement notice can result in penalties imposed by MBIE.

These measures ensure regulatory compliance and accountability within unit title developments.

Pecuniary Penalties under the Unit Titles Act

The Tenancy Tribunal can impose pecuniary (financial) penalties on a body corporate or body corporate manager if MBIE successfully applies to the Tribunal for non-compliance:

- Conditions: The breach must be intentional and without a reasonable excuse. Pecuniary penalties are monetary fines and do not result in a criminal record.

- Determining the Penalty: The Tribunal decides the amount based on the severity of the breach, up to the maximum amounts specified by law (between $1,500 and $5,000).

- Limitation on Liability: A body corporate or body corporate manager cannot be liable for more than one pecuniary penalty for the same conduct.

These penalties serve as deterrents and ensure compliance with the Unit Titles Act, upholding standards of governance and management within unit title developments.

Body Corporate Managers

The Amendment Act introduces new provisions for body corporate managers.

- Code of Conduct: The Amendment Act mandates a new code of conduct, requiring body corporate managers to meet specified ethical and professional standards.

- Engagement Requirements: Large unit title developments (10 or more principal units) must engage a body corporate manager unless opted out by special resolution.

- Regulatory Compliance: The Regulator may request necessary information from body corporates or managers for monitoring and investigating compliance with the Unit Titles Act.

- Manager’s Role and Contract Terms: The Amendment Act defines the role of a body corporate manager and outlines contractual terms, including duties, reporting requirements, compliance with the code of conduct, conflict management, and independent operation for each body corporate engaged.

These measures promote accountability and professionalism in managing unit title developments, ensuring compliance with legal standards and protecting stakeholders’ interests.

Need More Clarity? We Are Here to Help.

Navigating the changes to the Unit Titles Act can be complex. For a deeper understanding, or if you have any questions, don’t hesitate to reach out to Strata’s experts on 09 307 3721 or email bc@stratatitle.co.nz

The Unit Titles Act provides clarity in this regard with two key sections:

The Unit Titles Act provides clarity in this regard with two key sections: